personal property tax rate richmond va

The City Assessor determines the FMV of over 70000 real property parcels each year. Business Tangible Personal Property Tax Return Richmond.

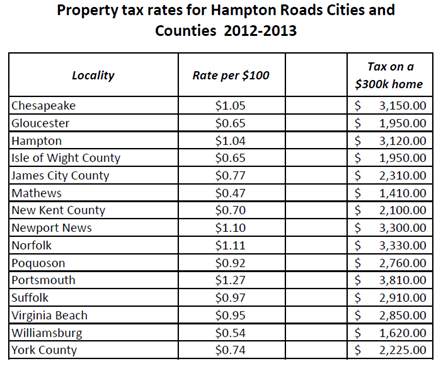

Taxes Mr Williamsburg Revolutionary Ideas On Real Estate Hampton Roads Virginia

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate.

. Assessment Methodology Individual. 074 of home value Tax amount varies by county The median property tax in Virginia is 186200 per year for a home worth the. Any returns filed after May 1 st are assessed a late filing fee of ten dollars 10 or ten percent 10 of the tax assessed whichever is greater.

The average yearly property tax paid by Richmond City residents amounts to about 346 of their yearly income. Tax Due Date Extended by City Council. Interest is assessed as of.

Admissions Lodging and Meals. Virginia Property Taxes Go To Different State 186200 Avg. See reviews photos directions phone numbers and more for Personal Property Taxes locations in Richmond VA.

Richmond City is ranked 387th of the 3143 counties for property taxes as a. The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts excluding the rental of vehicles licensed by the state from rental of personal. Under Virginia law the government of Richmond.

Business Tangible Personal Property Tax Return2021 2pdf. Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. Below you will find links and resources to pay admissions lodging meals real estate and personal property taxes as well as parking violations online.

We have done our best to provide links to information regarding the County and the many services it provides to its. Find details about tax types assistance starting your own business and more on our TaxFeeLicense Descriptions Page. December 5 th-- Real Estate Personal Property Taxes.

The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700. It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief. Contact the Treasurers Office at.

Make sure you receive bills for all property that you own. There are three basic steps in taxing property ie formulating levy rates assigning property market values and collecting tax revenues. Personal Property Taxes Personal Property taxes are billed annually with a due date of December 5 th.

Taxpayers now have until August 5 2022 to pay personal property tax car tax and machinery tools tax without penalty or interest. Tax rates differ depending on where you live. Richmond County collects on average 045 of a propertys.

Title Redirect financedescriptions Accessibility Auditor. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. The 10 late payment penalty is applied December 6 th.

If you have an issue or a question related to your personal property tax bill. Boats trailers and airplanes are not prorated. Welcome to the official Richmond County VA Local Government Website.

ALL RATES ARE PER 100 IN ASSESSED VALUE For Town of Warsaw tax rates please contact the Town of Warsaw office at 804 333-3737.

Assessor Of Real Estate Richmond

Click Here For Real Estate Tax Relief Program Grayson County Government

Chesterfield County Personal Property Taxes Skyrocket As Used Car Assessment Values Surge

For State Tax Purposes Is It Better To Live In Virginia Maryland Or Dc Quora

What Are Property Taxes In Richmond Va Reynolds Empowerhome Team

News Flash Chesterfield County Va Civicengage

Politifact Virginia Stoney Mostly True On Richmond Tax Claim Vpm

Richmond Sees Another Year Of Double Digit Percentage Increases In Property Tax Assessments

How To Reduce Virginia Income Tax

Where Residents Pay More In Taxes In Northern Va Wtop News

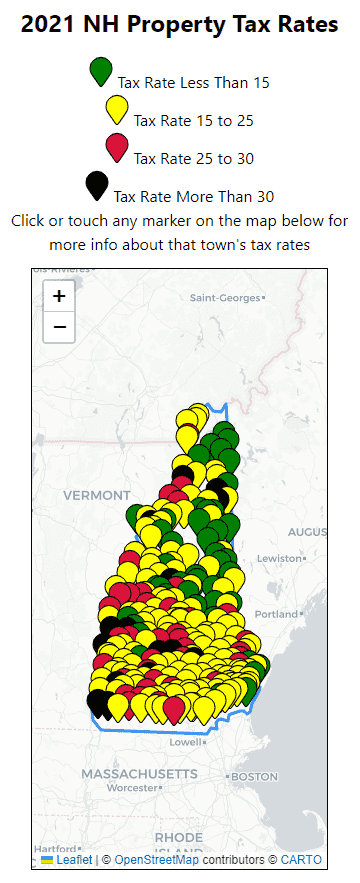

2021 New Hampshire Property Tax Rates Nh Town Property Taxes

Calls Mount For City S Property Tax Decision Richmond Free Press Serving The African American Community In Richmond Va

Hampton Roads Property Tax Rates 2012 2013 Mr Williamsburg

Solving Richmond S Money Problem Richmondmagazine Com

Value Of Used Cars Impacting Personal Property Taxes Vpm

Councilman Pushes For Tax Reform As Richmond Property Values Rise

Property Taxes How Much Are They In Different States Across The Us

Cities With The Highest And Lowest Taxes Turbotax Tax Tips Videos